Buying a House for the First Time: Everything We Learned

Buying a home is a big deal – especially when you are buying a house for the first time. While we aren’t experts, here are a few things we learned from buying two houses in the past few years.

Tips for First Time Home Buyers

We bought our first house in 2016.

In hindsight, we wish we had done things a *little* bit different.

For instance, when we were presented with an offer to get a beautiful house for about $50,000 less than it was worth…well, I think we should have looked a little bit more into it (that has is now worth about $200,000 more than what we would have bought it for!).

Overall, though, we are grateful we got the house we did, when we got it, and that we are now about to rent that home out.

We bought our second house just about six months ago, and it was a pretty smooth process.

We definitely learned from our last experience, and I think it helped us make the best choice for our home.

So if you are about to start the process of buying a house (or just in the midst of it!), I thought I’d share a few things we’ve learned that might be helpful to you.

Thank you to Homie for their continued partnership with Clarks Condensed

There is always another house

When you are looking at houses, it can be easy to get caught up in the emotions of it all.

You might think that if you don’t go above your asking limit, you’ll never find another house.

You may be tempted to settle for a house you don’t totally love because you are worried no other houses will ever come up.

I promise you – there is ALWAYS another house. It may not pop up right away, but another house will come around.

Do your research

Having a realtor on your side to help is important, but when it comes down to it, you are the one that’s going to need to do the research.

You will need to check into the local schools and parks and see if things are actually in walking distance that a listing says. For instance, some people sold the house across from us, and one of their main selling points was “just a quick bike ride to Whole Foods”, which was actually several miles away.

Ask your realtor to set up search parameters in the MLS so you can get a first look at homes as soon as they go on the market. I found this really helpful because we were able to go see houses as soon as they were listed.

Don’t expect your realtor to do everything for you – it’s your house! Do all the research you need to before putting in an offer or even starting to look at houses. Just knowing what area you want – and the reasons why – can be a great starting point.

Lots of transaction costs

One of the most frustrating parts of the buying and selling process of a home are the transaction costs! They really add up, and I think a lot of people are blindsided when they see everything involved.

These are typically referred to as “closing costs”, which usually include (according to NerdWallet):

- Appraisal Fee (we were able to get this waived with our recent home purchase)

- Survey Fee

- Underwriting and origination fees

- Document print fee

- Title insurance

In a competitive market, these can often be split between the buyer and seller (or even covered by the buyer entirely), but I would not go into the process assuming this will happen.

For a $300,000 house, this can be between $6000 and $15000!

The buyer/seller commission is usually about six percent, and this is split between the buyer and seller agent. This comes out of the profit of the house.

This is where working with Homie can be really beneficial – both as a buyer and a seller. In my last post, I talked a little bit about how Homie can save you money as a seller, but it can be just as beneficial as working with them as a buyer.

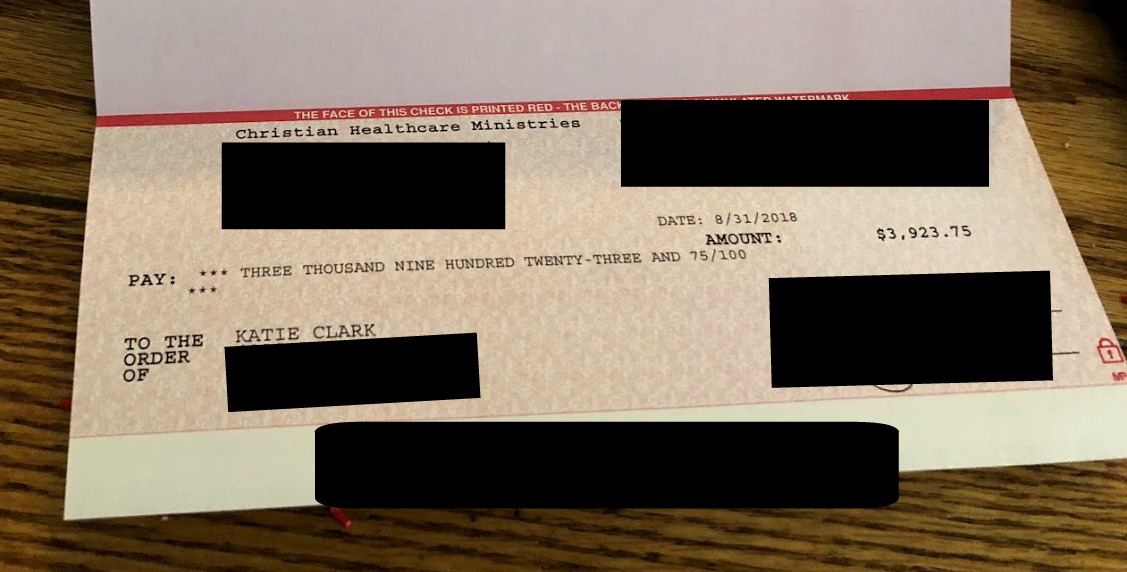

They have made the home buying process as streamlined as possible, which means that they can help save you time and money in the end. On average, they are able to refund buyers around $5000 in closing costs when all is said and done. On the purchase of a $300,000 home, Homie Buyers often save up to about $7500 total!

It’s also really easy to set up tours, as well as to work with their lenders to get qualified for a home loan. If you are in one of the areas where Homie exists (Utah and Arizona currently), you should check out their Buyer FAQs to learn more about how they make the process way easier for everyone involved. It’s even better when you can take advantage of a Homie-2-Homie deal!

A Good Realtor is Essential

There are a lot of realtors out there – I feel like every other person I know is a realtor!

But with any profession, not all of them are awesome, and it can make or break things when you are buying a home. You want someone who is going to take time to spend with you, not rush, and who will go to bat for you.

We worked with some wonderful realtors during both of our home buying experiences. When we bought our first home, the market here in Denver was fierce. I’m quite certain our choice of realator made a difference.

Again, if you live in Utah or Arizona, I have heard nothing but good things about using Homie. Their satisfaction rate is extremely high – in fact, they rival that of Amazon and Apple – and they are the #1 brokerage office in the state of Utah. They’ve been able to save their customers over $40 million in real estate commissions overall. So definitely a great option!

Don’t Be Afraid to Browse

Just because you look at a house doesn’t mean you have to buy it.

I think it can be helpful to go look at houses just for the sake of getting an idea of the different layouts. In our area, many of the houses have very similar layouts, so after we saw some, we knew if we wanted to even see a house in that layout again.

I’ve heard people say you should look at 50 houses before you make an offer. Do I agree with that? Not really. But I do think it’s important to point out that it is 100% OKAY just to look at houses, especially in the beginning stages when you are trying to decide for sure what to do.

We are lucky to live in a world where we can browse online before even looking at house. While I think nothing can replace actually looking at a house in person, being able to see all the details and photos online is so helpful!

Get everything in writing

Never take anyone’s word for something or just assume that something comes with the house.

We had a situation where the home we were buying where they originally were going to leave some items, and then I think we made them mad, so they came and took some of the things we wanted (and left the things we wanted out).

Everything needs to be in the contract and in writing. It will protect you now and in the future if something were to go wrong.

A quality inspector is a must

Everyone really needs to get an inspection done when buying a house (I think it’s required?).

But you should do due diligence to make sure your inspector does a good job.

For our first home, the guy was nice, but after we moved in, there were several issues that should have been discovered in the inspection process.

They should be fine with your walking around with them and asking questions, and it should take several hours.

You want to make sure they uncover anything that could possibly be wrong so that can be factored into the negotiation process.

And it is 100% worth it to get a sewer scope and a radon test done as well. It costs a little bit extra, but these can add significant cost if there is an issue (especially with the sewer).

Not everyone is honest

I’d like to believe everyone has the best of intentions, but it’s not always true.

People will often exaggerate or even make things up to try and get you to buy a house or raise your offer.

Sometimes you have to be willing to walk away, especially if you feel like someone is calling your bluff.

Have a good mortgage lender

We work with an amazing mortgage lender, and we felt 100% confident that he was getting us the best rate.

We were able to waive certain fees and close in three weeks, which is pretty amazing as well.

A good mortgage broker will lay out all your options and make the process as easy as possible. They will be able to tell you about any first time home buyer programs available, ways to save, and should make it stress-free (as much as they can!).

Not all mortgage lenders are the same, so make sure you do your due diligence in searching out a good one.

Again, if you live in an area where Homie exists, they have very experienced lenders on hand to help make the process as simple and streamlined as possible. You’ll likely end up saving a lot in the end by using one of them!

No house is perfect

I think this is one of the most important things to remember – no house is going to check off EVERY single checkbox on your list.

While you certainly shouldn’t just settle for anything, you also need to prioritize. If you find a house that has 9 out of 10 of the things you want, it might be worth considering if that one item is worth passing on the house entirely for.

I do recommend making a list and deciding what items are non-negotiable. In hindsight, had we done that with our first house, we may not have chosen it. But at the time, I didn’t realize how important certain factors (such as having all the rooms on the same floor, a master bathroom, etc) would be to me!

At the end of the day, buying a house is a big deal – and it’s an exciting time. It can be easy to get overwhelmed and not be sure what to do – but when you break things down into smaller, bite-sized pieces, it makes a world of difference.

Other Posts You May Enjoy:

It is so scary to buy a house! I don’t know how you had the nerve to buy two houses, haha! Great tips!

This is a great read!!! I hope Homie comes to Colorado by the time we’re ready to buy!